This product is not intended to provide legal or financial advice or substitute for the advice of an attorney or legal advisor. Discount applies to the annual service fee for QuickBooks Desktop Enhanced Payroll only, and does not apply to the per employee fee (2 per employee per month). Find out more about managing reports in QuickBooks Desktop through the following articles: Understand reports. Select More Payroll Reports in Excel, then Employee Time & Costs. Depending on your company’s industry, type of commerce, location or workforce, additional specialized notices may be required by your municipality or agencies regulating your industry or area. After the first year of service, you will automatically be charged at the then current rate for your QuickBooks Desktop Enhanced Payroll subscription. Lets run the Employee Time & Cost in QuickBooks Desktop (QBDT). Workers’ Compensation Service requires a paid Intuit payroll subscription.ĥ.Intuit QuickBooks publishes labor law posters that include all generally required notices for employers. QuickBooks Payroll is the 1 Payroll Brand SAVE TIME AND ENERGY Need help choosing Call 88 Enhanced Payroll Enhanced gives you the tools to pay employees faster and get ready for tax time. Visit QuickBooks Time to learn more.Ĥ.Workers’ comp insurance is required for most businesses with employees, in all states except Texas.

QUICKBOOKS DESKTOP PAYROLL COST HOW TO

This is available in Quickbooks Payroll Enhanced and to selected states only.Ģ.For hours of support and how to contact support, click here.ģ.QuickBooks Time subscription required, additional fees may apply. Also, you can set the payment method for your scheduled Federal and State tax payments to E-Pay, and conveniently pay the appropriate tax agencies in QuickBooks Desktop. Instead of printing and mailing the forms, send them electronically to the appropriate agencies in QuickBooks Desktop.

QUICKBOOKS DESKTOP PAYROLL COST SOFTWARE

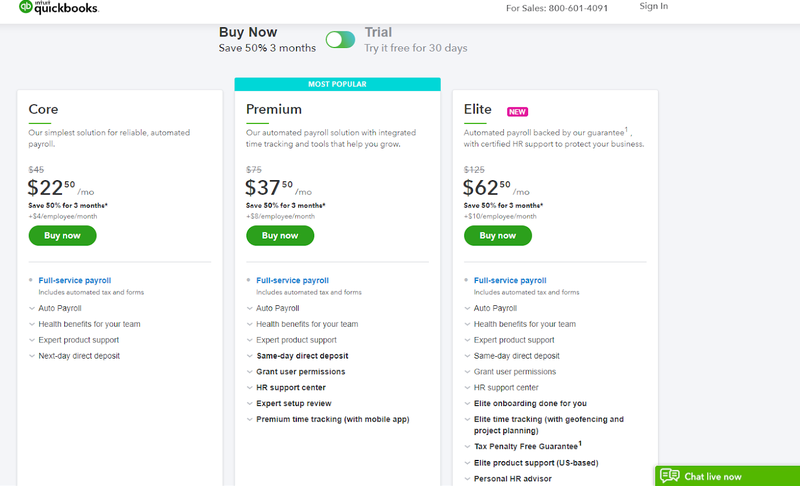

Call 88QuickBooks Mobile App - 5280 Software LLC has the best custom solutions to help you realize. Here’s a look at QuickBooks Payroll plans and pricing for desktop. 1.E-file and E-pay: You can set the filing method of your Federal and State forms to E-file. 5280 Software LLC develops custom mobile apps to integrate with QuickBooks software.

0 kommentar(er)

0 kommentar(er)